HengCang-Tech (Zhuhai HengCang Electronic Technology Co., Ltd.), founded in 2003, is a small-scale enterprise but carries 20 years of deep expertise in mechanical keyboard production—a legacy rooted not just in time, but in its core team’s decades-long immersion in the industry. This heritage means HengCang-Tech didn’t start from scratch: it inherited proven techniques for switch tactile tuning, PCB circuit optimization, and durability testing, allowing it to skip the costly "trial-and-error" phase that derails most new entrants. In the new market environment—where consumers demand both reliability and customization—this technical lineage has made HengCang-Tech a trusted carrier of mature manufacturing know-how, capable of translating legacy expertise into modern, market-ready products.

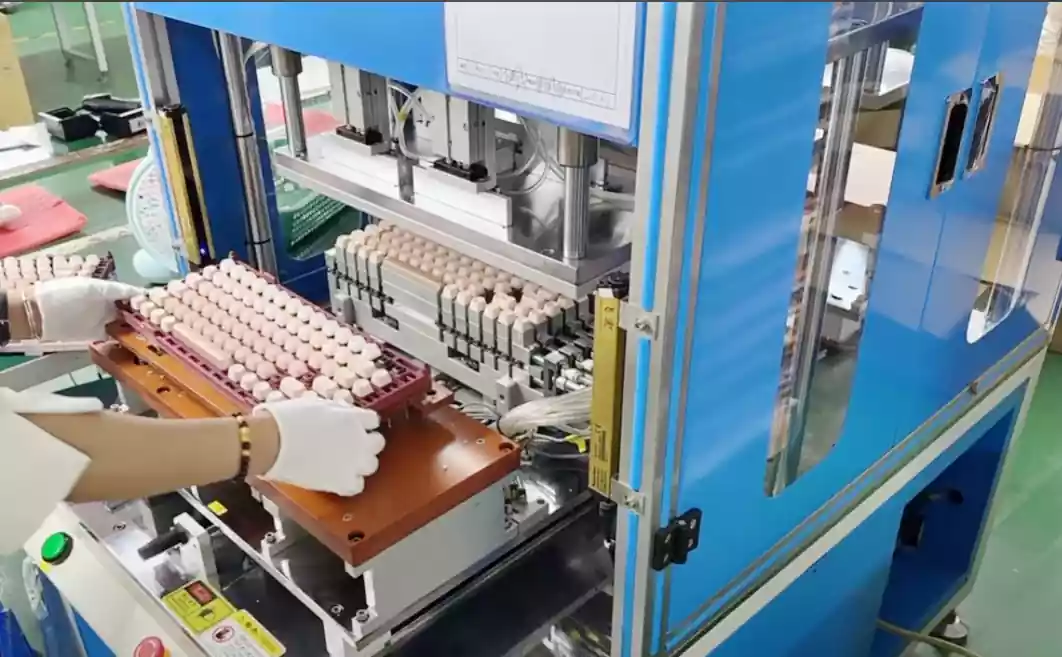

As a National High-Tech Enterprise and Technology-Based SME, HengCang-Tech reaps tangible benefits from national policy support: it enjoys a 15% corporate income tax rate (vs. the standard 25% for non-high-tech firms), has secured over RMB 500,000 in government R&D grants since 2020, and qualifies for subsidies to hire senior engineers. These perks have been critical for a small enterprise with limited capital, as they’ve freed up resources to invest in patent development—including key innovations like "mechanical keyboard satellite axis mounting structures" and "intelligent visual inspection equipment." Yet, like all innovative small businesses, HengCang Tech faces persistent challenges. Sustaining R&D investment amid tight cash flow remains a struggle: its annual R&D budget, though 8% of revenue (higher than the industry average for SMEs), is still a fraction of the 12–15% spent by large competitors like Logitech. It also grapples with industry volatility—for example, the 2022 global chip shortage delayed production for 6 weeks, and fluctuations in aluminum prices (a key material for keyboard shells) have squeezed profit margins by 5–7% in recent years. To counter these pressures, its intensive patent applications—over 30 filed since 2021, covering core structures, automated equipment, and quality control—are more than just IP assets: they’re a proactive strategy to build a competitive barrier, ensuring it stands out in a market flooded with generic OEMs.

Growth milestones further illustrate HengCang Tech’s steady expansion trajectory. Its relocation from Hengqin New Area to Zhuhai Nanping Science and Technology Industrial Park in 2016 was a transformative move: the new industrial park, a hub for electronic manufacturing in the Pearl River Delta, brought immediate gains. Proximity to key suppliers (e.g., Shenzhen-based switch manufacturers and PCB producers) cut supply chain costs by 12% and shortened delivery lead times from 7 days to 3 days. The larger 2,000-square-meter facility also allowed it to add two automated assembly lines, boosting annual production capacity from 300,000 units to 800,000 units—enough to meet bulk orders from regional and global clients. Equally strategic was its expansion of business scope: adding "R&D, production, and sales of gaming peripherals" in 2018 tapped into the booming esports market (valued at $1.3 billion globally that year), with its first gaming keyboard model—featuring low-profile switches and RGB backlighting—gaining a 15% market share in Southeast Asia within 12 months. Later, adding e-commerce and import-export capabilities opened doors to direct sales via platforms like Amazon and AliExpress, letting it bypass middlemen, increase profit margins by 18%, and gather real-time user feedback to refine products (e.g., adjusting switch tension based on reviews from Western gamers).

The key to HengCang Tech’s leap from "small enterprise" to "industry leader" lies in striking a balance between safeguarding its core strength—mechanical keyboard manufacturing—and leveraging its high-tech certification to innovate. On the production front, it plans to invest further in intelligent and automated systems: this year, it will pilot an AI-driven production scheduling tool that uses real-time data to optimize assembly line workflows, with the goal of cutting production time per unit by 20%. On the brand front, it’s exploring brand 化 operations beyond OEM/ODM—having filed trademarks like "FUNOUZEL" (for consumer gaming keyboards) and "POSKEY" (for industrial POS keyboards) to build direct-to-consumer recognition. For global brands seeking "reliable mechanical keyboard OEM/ODM" or "tech-driven small-scale manufacturers," HengCang Tech’s 20-year focus on its craft and adaptive strategy make it a standout partner. It’s not just a manufacturer; it’s a collaborator that combines legacy expertise with forward-thinking innovation—exactly what’s needed to thrive in a fast-changing consumer electronics landscape.to Zhuhai Nanping Science and Technology Industrial Park (boosting production efficiency and supply chain access) and expanded business scope to include "R&D, production, and sales of gaming peripherals," e-commerce, and import-export—catering to the booming esports market and global client demands.

The key to HengCang-Tech’s leap from "small enterprise" to "industry leader" lies in balancing its core strength in keyboard manufacturing with leveraging its high-tech certification: advancing intelligent/automated production and exploring brand operation. For global brands seeking "reliable mechanical keyboard OEM/ODM" or "tech-driven small-scale manufacturers," HengCang Tech’s 20-year focus and adaptive strategy make it a standout partner.